hermes gpe infrastructure | hermes infrastructure uk hermes gpe infrastructure Infrastructure. Natural Capital. Focused on delivering consistent alpha through access to some of the most innovative and resilient companies and General Partners (GPs) in hard-to-reach . Adena Mansion & Gardens is offering ten guests to experience dinner and .

0 · hermes infrastructure uk

1 · hermes infrastructure investments

2 · hermes infrastructure investment management

3 · hermes infrastructure fund i lp

4 · hermes infrastructure cppib

5 · hermes gpe infrastructure fund lp

6 · hermes gpe infrastructure fund ii

7 · federated hermes infrastructure

976 results. Sort by: Relevancy. Clear Acrylic Business Card Holder Vase Office Desk Decor Pencil Craft Tabletop Holder Coworker Boss Office Gift - Acrylic Holder Only. .

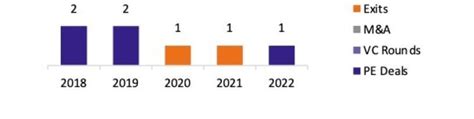

At Federated Hermes, our Infrastructure team specialises in providing institutional investors with cost-effective access to largely UK-focused equity investments across a broad spectrum of .Federated Hermes Infrastructure activities. Our business unit and individual performance objectives include sustainability and stewardship related goals, achievement of which is .Infrastructure. Natural Capital. Focused on delivering consistent alpha through access to some of the most innovative and resilient companies and General Partners (GPs) in hard-to-reach . The fund targeted information technology, software, infrastructure, commercial transportation, renewable energy, and consumer products and services (B2C) sectors. The .

Hermes GPE Infrastructure Fund. Vintage: 2014. Size: .7B. Dry Powder: M. Details: The fund invests in consumer products and services (B2C), IT, software industries and its .Hermes GPE Infrastructure Fund II is a 2017 vintage infrastructure value added fund managed by Hermes Infrastructure. The fund is based in London, United Kingdom. The fund will focus on . Hermes Fund Managers (Hermes) has held an interim close on its Hermes GPE Infrastructure Fund, having raised an additional £210 million (€264 million; 9 million) to .Hermes GPE LLP (“HGPE” or “the Firm”) is a specialist investor in global private markets and manages £9.3bn of capital for leading global pension funds and institutional investors. The .

CORPORATE GOVERNANCE OF PUBLIC SERVICE INFRASTRUCTURE ASSETS. Peter Hofbauer, Head of Infrastructure at Hermes Investment Management, makes the case for an .Hermes GPE’s investment strategy is forward-looking, inherently dynamic, considering macro-economic and market developments to ensure effective portfolio construction. We leverage our .

hermes infrastructure uk

At Federated Hermes, our Infrastructure team specialises in providing institutional investors with cost-effective access to largely UK-focused equity investments across a broad spectrum of infrastructure opportunities.Federated Hermes Infrastructure activities. Our business unit and individual performance objectives include sustainability and stewardship related goals, achievement of which is factored into our annual appraisal and compensation framework. The Head of Infrastructure, Infrastructure Investment Committee and the Hermes GPE LLP Executive CommitteeInfrastructure. Natural Capital. Focused on delivering consistent alpha through access to some of the most innovative and resilient companies and General Partners (GPs) in hard-to-reach areas of the global private equity market. Private companies are the innovation backbone of the global economy, powering the world’s long-term growth. The fund targeted information technology, software, infrastructure, commercial transportation, renewable energy, and consumer products and services (B2C) sectors. The fund preferred to make impact investments in infrastructure.

Hermes GPE Infrastructure Fund. Vintage: 2014. Size: .7B. Dry Powder: M. Details: The fund invests in consumer products and services (B2C), IT, software industries and its infrastructure asset preferences are renewable energy, .Hermes GPE Infrastructure Fund II is a 2017 vintage infrastructure value added fund managed by Hermes Infrastructure. The fund is based in London, United Kingdom. The fund will focus on infrastructure, transportation and renewable energy assets.

Hermes Fund Managers (Hermes) has held an interim close on its Hermes GPE Infrastructure Fund, having raised an additional £210 million (€264 million; 9 million) to bring the total amount raised so far to more than £700 million.Hermes GPE LLP (“HGPE” or “the Firm”) is a specialist investor in global private markets and manages £9.3bn of capital for leading global pension funds and institutional investors. The HGPE platform comprises two distinct businesses, one investing .CORPORATE GOVERNANCE OF PUBLIC SERVICE INFRASTRUCTURE ASSETS. Peter Hofbauer, Head of Infrastructure at Hermes Investment Management, makes the case for an enhanced corporate governance regime for private infrastructure businesses providing essential public services in the UK.

Hermes GPE’s investment strategy is forward-looking, inherently dynamic, considering macro-economic and market developments to ensure effective portfolio construction. We leverage our global partner network to source investment opportunities across a wide spectrum of different investment themes and geographies.At Federated Hermes, our Infrastructure team specialises in providing institutional investors with cost-effective access to largely UK-focused equity investments across a broad spectrum of infrastructure opportunities.Federated Hermes Infrastructure activities. Our business unit and individual performance objectives include sustainability and stewardship related goals, achievement of which is factored into our annual appraisal and compensation framework. The Head of Infrastructure, Infrastructure Investment Committee and the Hermes GPE LLP Executive Committee

Infrastructure. Natural Capital. Focused on delivering consistent alpha through access to some of the most innovative and resilient companies and General Partners (GPs) in hard-to-reach areas of the global private equity market. Private companies are the innovation backbone of the global economy, powering the world’s long-term growth. The fund targeted information technology, software, infrastructure, commercial transportation, renewable energy, and consumer products and services (B2C) sectors. The fund preferred to make impact investments in infrastructure.

hermes infrastructure investments

Hermes GPE Infrastructure Fund. Vintage: 2014. Size: .7B. Dry Powder: M. Details: The fund invests in consumer products and services (B2C), IT, software industries and its infrastructure asset preferences are renewable energy, .

Hermes GPE Infrastructure Fund II is a 2017 vintage infrastructure value added fund managed by Hermes Infrastructure. The fund is based in London, United Kingdom. The fund will focus on infrastructure, transportation and renewable energy assets.

Hermes Fund Managers (Hermes) has held an interim close on its Hermes GPE Infrastructure Fund, having raised an additional £210 million (€264 million; 9 million) to bring the total amount raised so far to more than £700 million.Hermes GPE LLP (“HGPE” or “the Firm”) is a specialist investor in global private markets and manages £9.3bn of capital for leading global pension funds and institutional investors. The HGPE platform comprises two distinct businesses, one investing .CORPORATE GOVERNANCE OF PUBLIC SERVICE INFRASTRUCTURE ASSETS. Peter Hofbauer, Head of Infrastructure at Hermes Investment Management, makes the case for an enhanced corporate governance regime for private infrastructure businesses providing essential public services in the UK.

hermes infrastructure investment management

hermes infrastructure fund i lp

Wallet:https://go.magik.ly/ml/jva4/Key Pouch:https://go.magik.ly/ml/jvad/Hi my beauties. I haven’t done a designer unboxing/ review in a while. Sharing this .

hermes gpe infrastructure|hermes infrastructure uk